How It Works

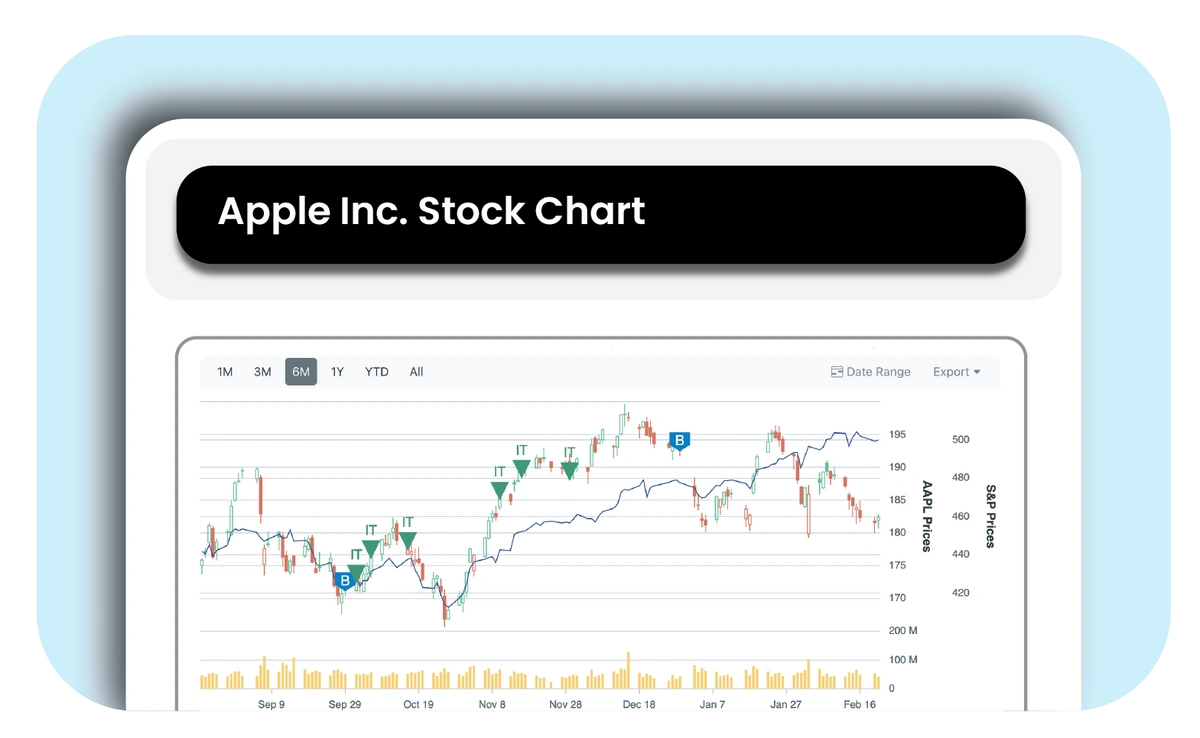

Visualize your investment landscape through dynamic charts, providing clarity in every trend.

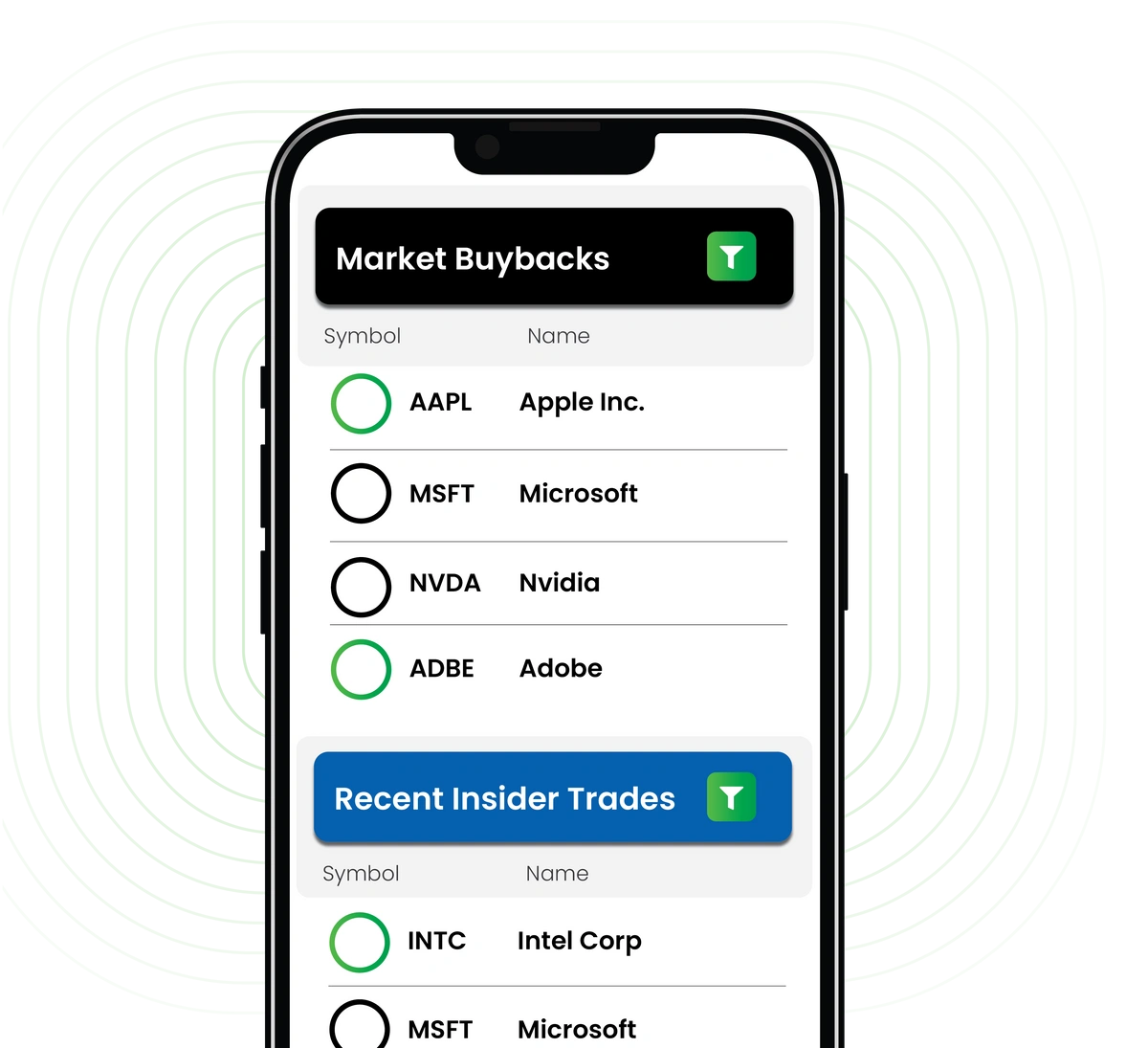

Create customized watchlists tailored to you interests, tracking stocks engaged in share repurchases or buzzing with insider activity.

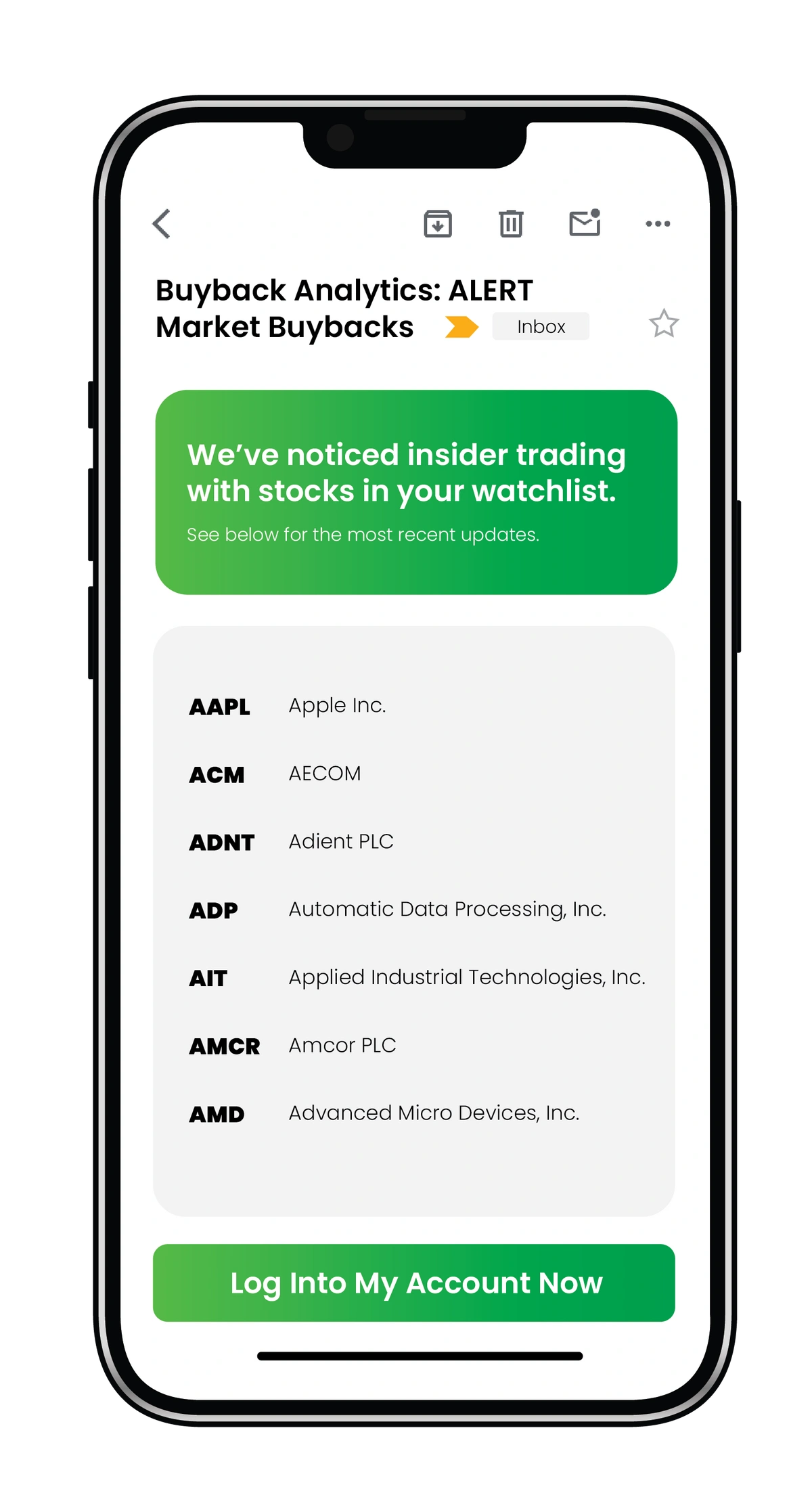

Stay ahead of the game with timely email alerts, keeping you informed of crucial insider movements and buyback activities within your watchlist. Experience seamless monitoring and stay empowered in your investment decisions.

| Ability to screen for trades and corporate buyback | |

| Timely Email Alerts To Your Phone | |

| Create Watchlists |

Our Top Features

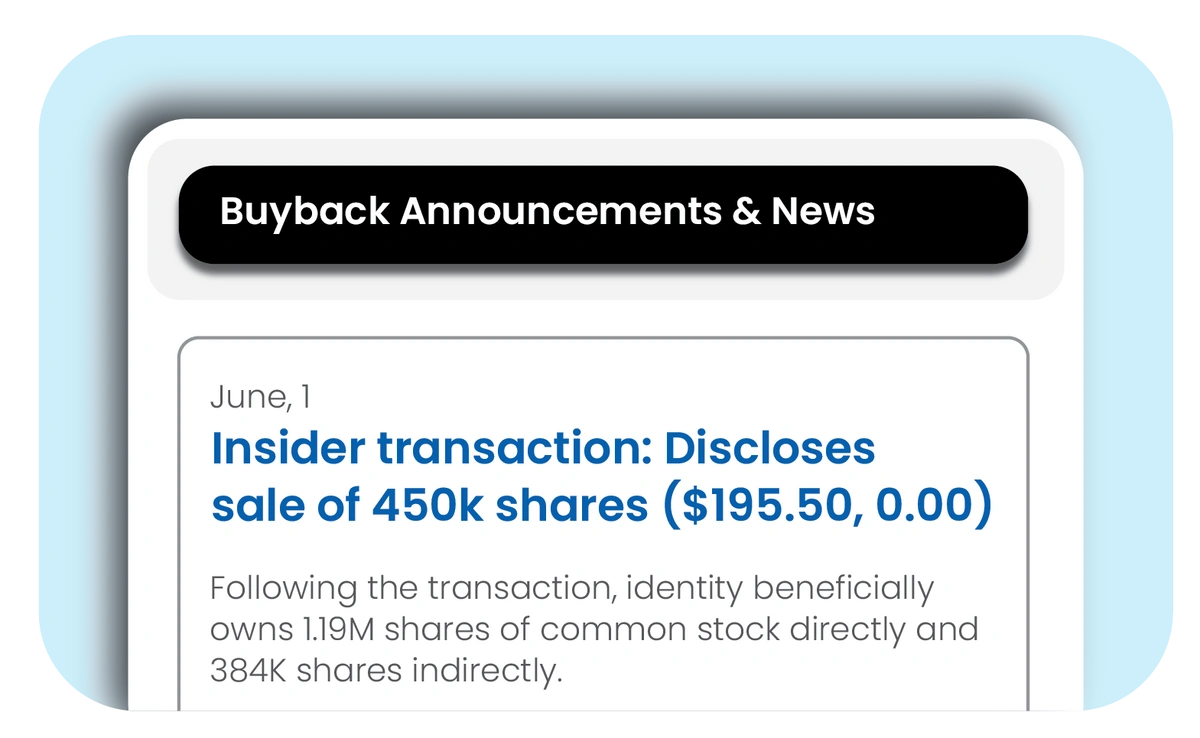

No other company allows you to track insider activity against shared priced movement. We are always monitoring and analyzing share repurchase activities undertaken by companies. Companies engage in buybacks to re-absorb portions of their ownership, signaling confidence in their stock and potentially boosting its value.

Quick Search Results

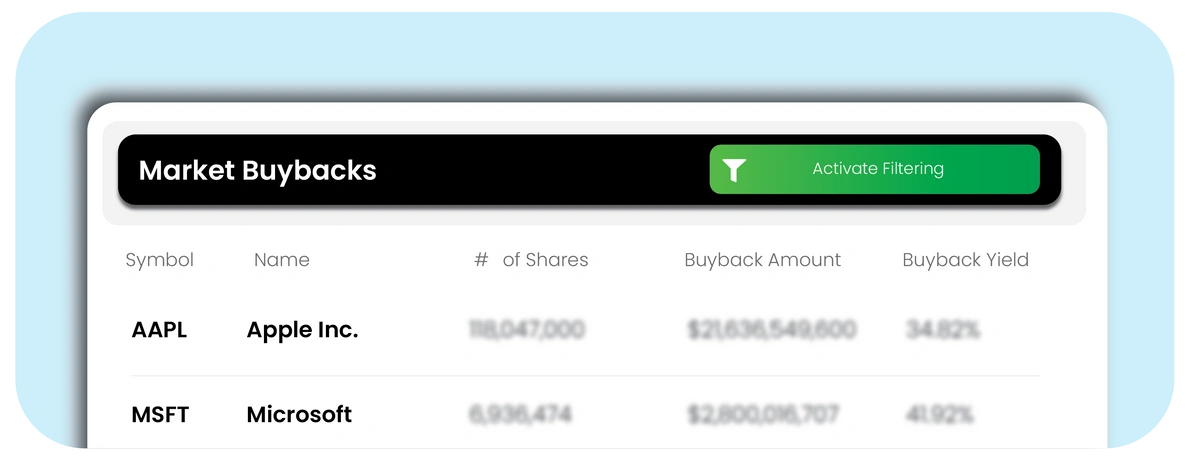

Search for stocks that are actively in the market repurchasing their stock.

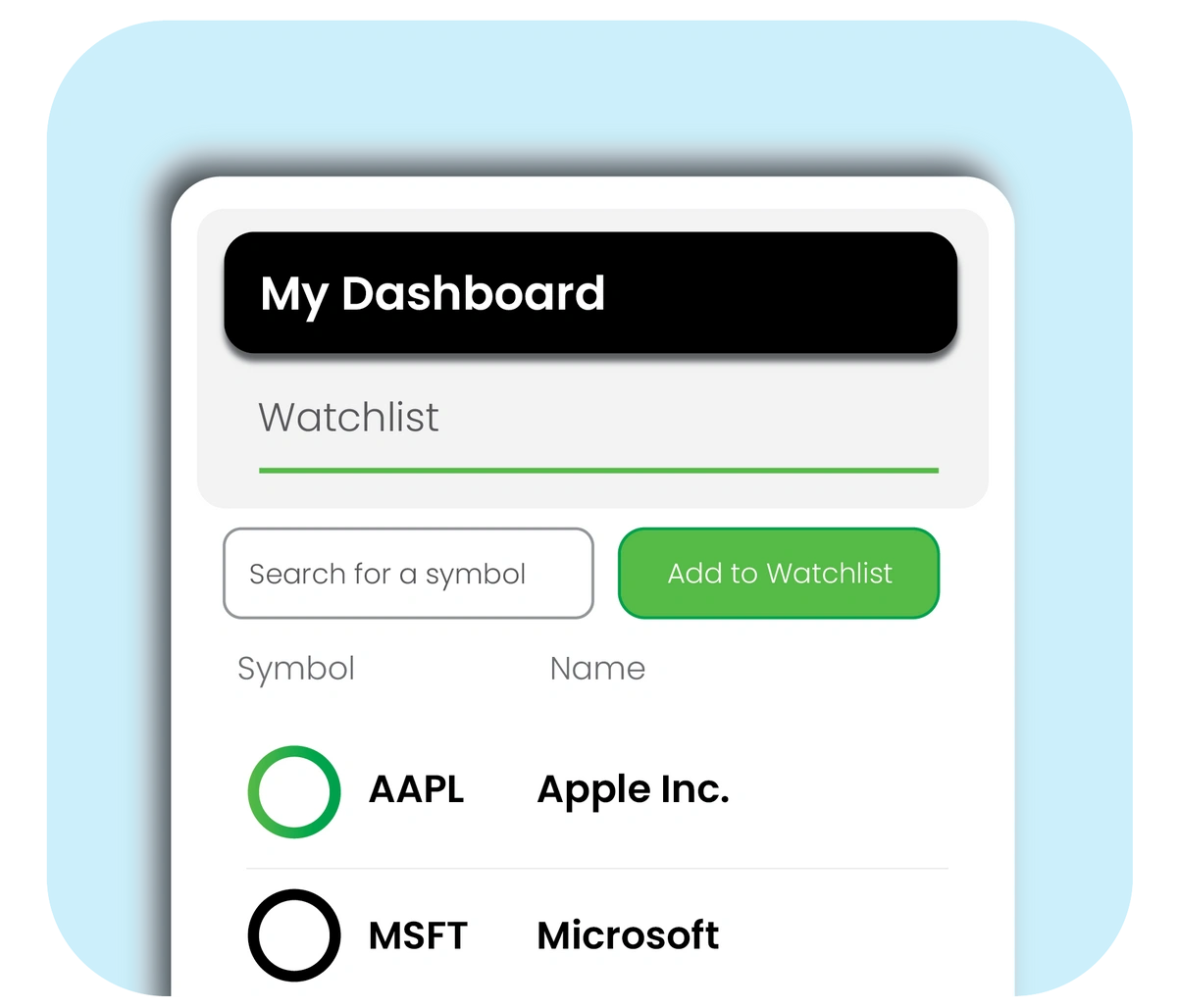

Create a watchlist

Build your own personalized watchlist in minutes.

Buybacks & Insider Trading

We provide timely information and guidance on share repurchase and insider trading, aiding investors in decision-makin

Easy to read charts

We help you understand buyback analytics so you can assess company's performances, manage with confidence, and predict potential future stock movements.

We monitor for you

We send you notifications so you do not have to miss out on missed opportunities.

Frequently Asked Questions

What are stock buybacks and why do they matter to investors?

When a company buys back its own shares, it reduces the number of shares on the market—boosting earnings per share and often signaling confidence in long-term value. Investors use this as a signal for strong capital allocation.

How can tracking stock buybacks improve my investment strategy?

Buybacks help identify companies with stable cash flow and undervalued stock. By tracking this data, you gain insight into which firms are allocating capital efficiently before the market reacts.

What’s included in the Free Membership at BuyBack Analytics?

Free members get access to a simplified dashboard, weekly summaries, and limited alerts. It's ideal for casual investors and those new to analyzing stock buyback activity.

Who is the Passive Investor plan designed for?

The Passive Investor plan ($29/month) is built for those who want curated insights without complexity. It includes state-level filters, smarter alerts, and monthly trend breakdowns.

What do Active Investor members get for $49/month?

Active Investor members receive full access to real-time alerts, float reduction analysis, insider overlays, and exclusive tools for high-frequency decision-making.

How is BuyBack Analytics different from a traditional stock screener?

Traditional screeners focus on price and earnings. BuyBack Analytics focuses on capital behavior—helping investors find undervalued stocks based on repurchases and insider action.

Can buybacks really help me find undervalued stocks?

Yes. Many companies quietly reduce their float before price momentum begins. Tracking this behavior gives you a lead on value plays not yet priced in.

Is BuyBack Analytics useful if I already use Yahoo Finance or Seeking Alpha?

Definitely. BuyBack Analytics complements these platforms by highlighting capital behavior—showing you which companies are taking action behind the scenes.